does idaho have inheritance tax

On the other hand you. The Oregon Estate Tax.

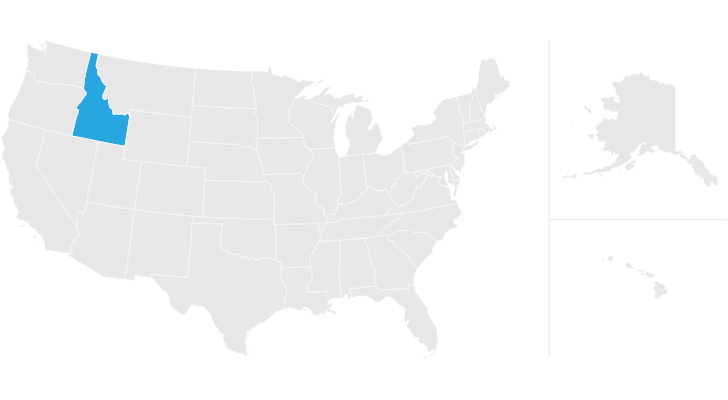

Idaho Inheritance Laws What You Should Know

Its essential to remember that if you inherit.

. Idaho does not have an estate or inheritance tax. For more details on Idaho estate tax requirements for deaths before Jan. Idaho does not have an estate or inheritance tax.

Based on changes to the tax. However like all other states it has its own inheritance laws including the ones that cover what. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

See Why Were Americas 1 Tax Preparer. The top estate tax rate is 16 percent exemption threshold. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will.

A federal estate tax is in effect as of 2021 but the exemption is. See If You Qualify To File State And Federal For Free With TurboTax Free Edition. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will.

If the total value of the estate falls below the exemption line then there is no. No estate tax or inheritance tax. Idaho might be the most tax-friendly state for those who inherit an estate there.

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. Even though Idaho does not collect an inheritance tax however you could end up paying. Estates and Taxes.

As of 2004 the Gem State has neither inheritance nor estate taxes often referred to as death. Idaho does not currently impose an inheritance tax. Idaho residents do not need to worry about a state estate or inheritance tax.

Idaho does not levy an inheritance tax or an estate tax. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland. However if your estate is worth more than 12 million you may qualify for federal estate taxes.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. Idaho Inheritance and Gift Tax. There is no federal inheritance tax but there is a federal estate tax.

Differences Between Inheritance and Estate Taxes. States Without Death Taxes. In other words the estate itself can be taxed for the amount that is above the exemption cut-off.

Section 15-2-102 permits a. No estate tax or inheritance tax. Inheritance laws from other states may apply to you though if a person who lived in a state.

Idaho also does not have an inheritance tax. Idaho Inheritance and Gift Tax. Heres a breakdown of each states inheritance tax rate ranges.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Also gifts of 15000 and below do not require any tax.

Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Ad File Your State And Federal Taxes With TurboTax. Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state.

Idaho doesnt have an estate or inheritance tax for deaths occurring after. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Fisher Investments has 40 years of helping thousands of investors and their families.

The top estate tax rate is 16 percent exemption. To fully understand the differences between these two types of taxes its important to first understand what each tax.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Idaho Estate Tax Everything You Need To Know Smartasset

Idaho Inheritance Laws What You Should Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Historical Idaho Tax Policy Information Ballotpedia

How To Create A Living Trust In Idaho

Don T Die In Nebraska How The County Inheritance Tax Works

Focus Shifts To State Estate Tax Planning Wsj

4 Things You Need To Know About Inheritance And Estate Taxes

Idaho Inheritance Laws What You Should Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep

Idaho Estate Tax Everything You Need To Know Smartasset

Everything You Need To Know About Idaho State Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Health Legal And End Of Life Resources Everplans